san antonio property tax rate 2020

Taxing Unit Name Phone area. 2020 Tax Rate Calculation Worksheet Form 50-856.

Property Taxes My City Is My Home

Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for.

. A delinquent tax incurs interest at the rate of 1 for the first month and an additional 1 for each month the tax remains delinquent. The average homeowner in Bexar County pays 2996 annually in property taxes on a median home value of 152400. Carlos Valenzuela 210-207-3919 carlosvalenzuelasanantoniogov SAN ANTONIO Aug.

City of San Antonio. Bexar County collects on average 212 of a propertys assessed fair. Alamo Community College District.

Many properties in the region are held by a taxing district which includes about half a dozen. In addition to interest delinquent taxes incur the following. In San Antonio the countys largest city and the second-largest city in.

Taxing Units Other Than School Districts or Water Districts. It shaves 001 which amounts to the 5000 minimum off the appraised values of. CITY OF SAN ANTONIO 210 207-5734.

The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100. San Antonio implemented its first homestead exemption the minimum allowed by the state in 2020. Box is strongly encouraged for all incoming.

Due to a change in the statue participating jurisdictions may elect to turn over their delinquent business property taxes to their delinquent tax attorneys for collection on April 1st of the year. Debt Service Tax Rate Total Tax Rate. Should the current public health situation considered a disaster.

South San Antonio ISD. This year the effective tax rate in the City of San Antonio is 54266 cents per 100 valuation. This notice provides information about two tax rates used in adopting the current tax years tax rate.

The no-new-revenue tax rate would Impose the same amount of taxes as last year if you. San Antonio River Authority. The Official Tax Rate.

City of San Antonio Print Mail Center Attn. PersonDepartment 100 W. Thats nearly 13 lower than San Antonios total property.

Adopted Tax Rate per 100 valuation General Operations MO 08546. On the lower spectrum of tax rates when it comes to incorporated cities Selmas total property tax rate is 237 per hundred dollars. The law caps property taxes at 35 unless voters approve an increase or a disaster triggers a rate increase to 8.

Mailing Address The Citys PO. Thea Setterbo 210-207-7349 theasetterbosanantoniogov Spanish media. SAN ANTONIO June 16 2022 Today the San Antonio City Council unanimously approved new property tax relief measures that will bring relief to taxpayers this fall.

San Antonio TX 78205. Road and Flood Control Fund.

2022 Property Tax Rate Comparison Reno San Antonio San Francisco Houston Longview Nyc Youtube

U S Cities With The Highest Property Taxes

How Property Taxes Have Changed Skyrocketed In San Antonio Neighborhoods

Lewisville City Council Votes To Keep Same Property Tax Rate For Fy 2021 22 Community Impact

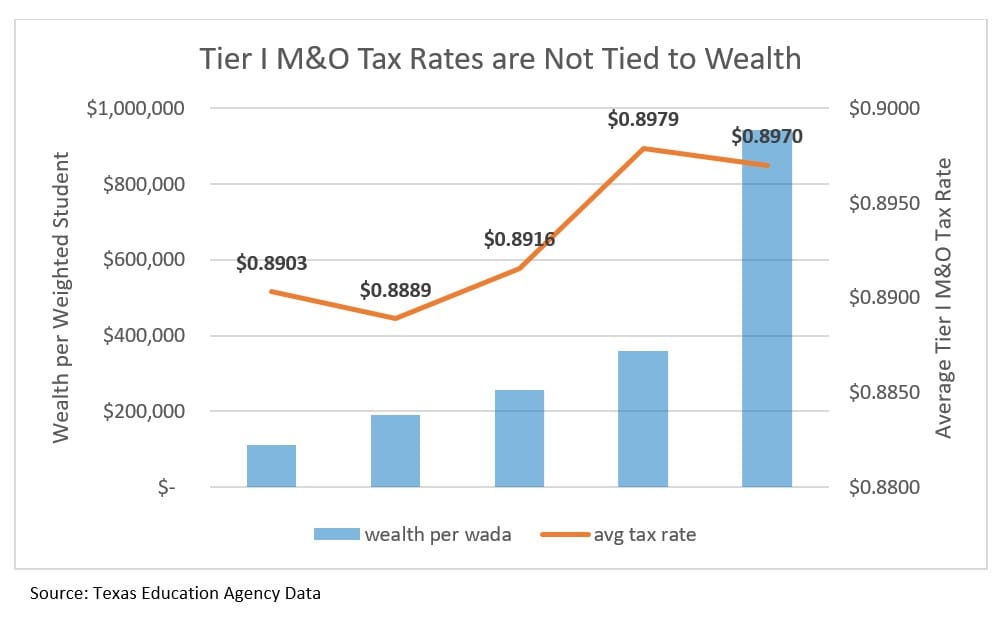

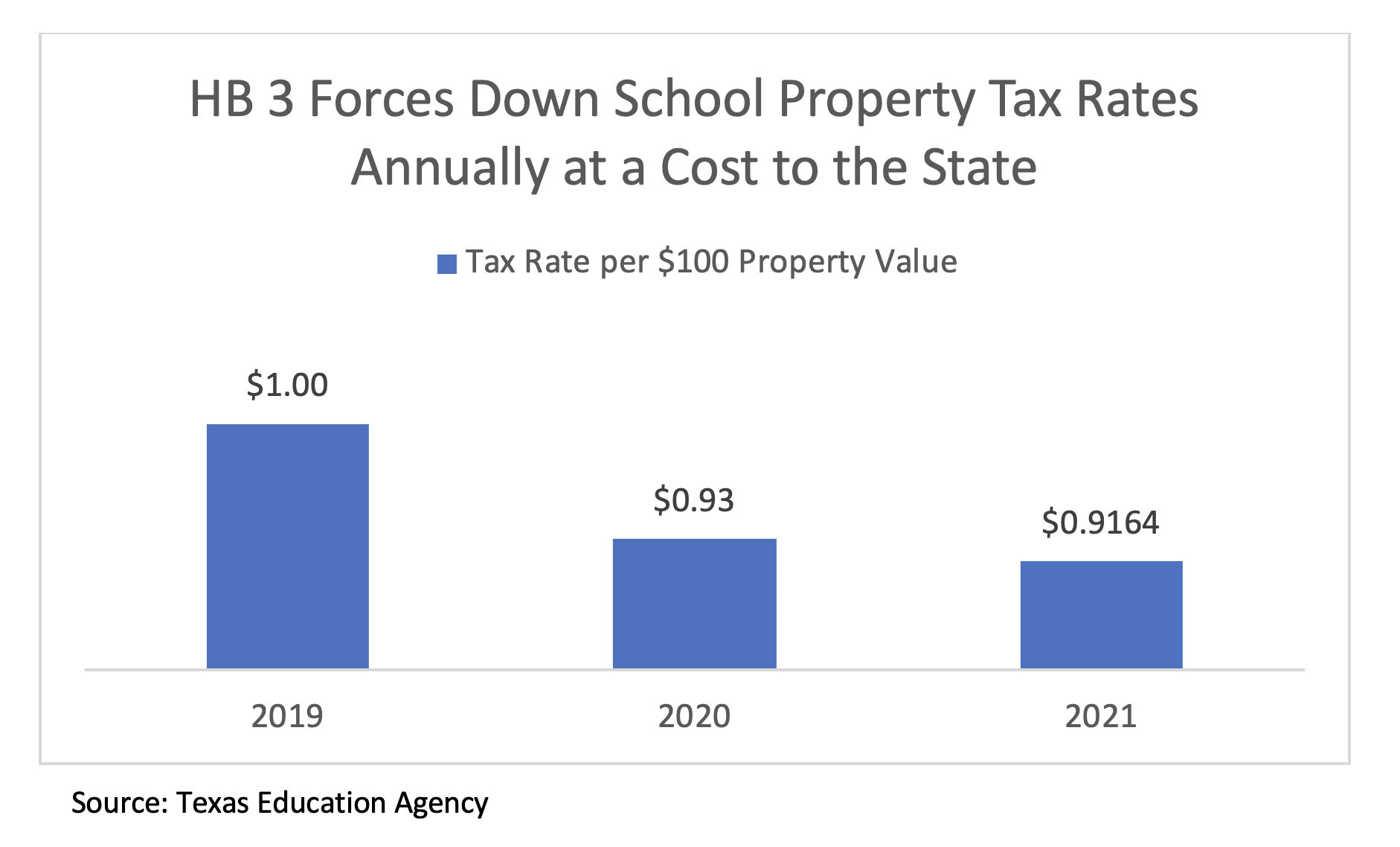

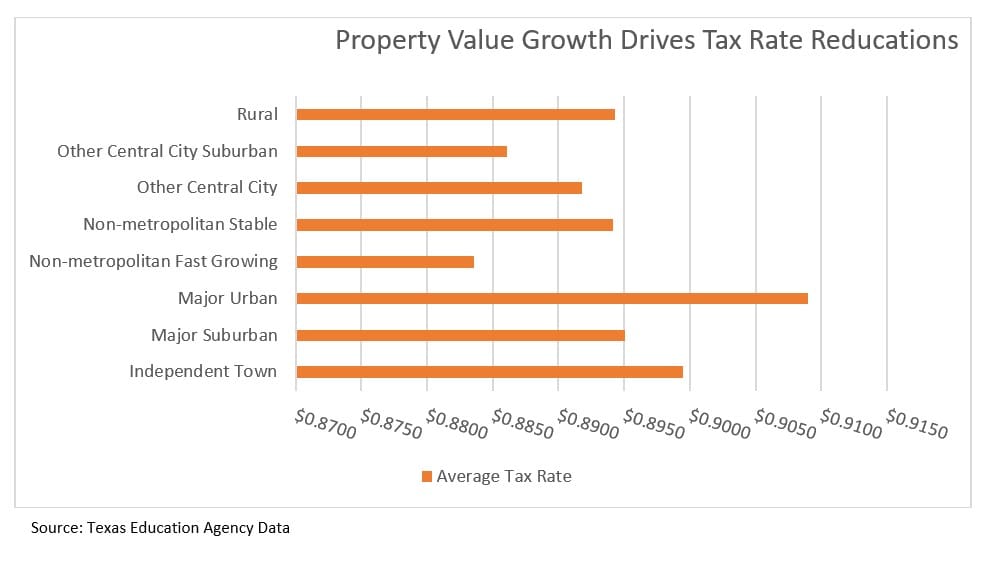

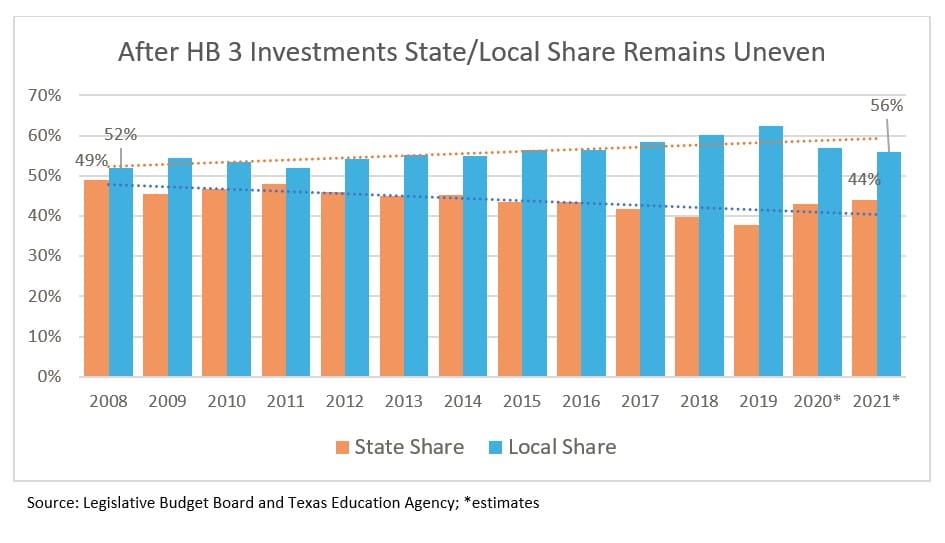

A New Division In School Finance Every Texan

Analysis Texas Government S Favorite Local Tax

A New Division In School Finance Every Texan

District 2 Councilman Votes To Approve Increasing Residential Homestead Exemptions And Calls For More To Be Done To Prevent Displacement And Provide Relief For Working Families The City Of San Antonio

A New Division In School Finance Every Texan

A New Division In School Finance Every Texan

Tax Breaks For Developers Under Scrutiny In San Antonio Texas Capitol San Antonio Heron

Chicago Has The 2nd Highest Commercial Property Taxes Of Major U S Cities Wirepoints

San Antonio To Cut Property Tax Rate Expand Homestead Exemption

San Antonio Property Tax How Does It Compare To Other Major Cities

Filing Property Tax Exemptions Living In San Antonio Texas Youtube

Pro Tax Or Protest Todoelpaso Com

Market Information Schertz Economic Development Corporation

Which Texas Mega City Has Adopted The Highest Property Tax Rate