richmond property tax rate 2021

10249 Staff Recommendation 1. That the Annual Prope1ty Tax Rates 2021 Bylaw No.

About Your Tax Bill City Of Richmond Hill

This year the city chose to select the compensating rate for the 2021 rates.

. 3470 apartments 6 units. Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Union of BC Municipalities.

Vehicle License Tax Antique. What is the due date of real estate taxes in the City of Richmond. Ultimate Richmond Real Property Tax Guide for 2021.

Real property consists of land buildings and attachments to the land andor buildings. That 11135 rate she stated would ensure the city would receive about the same amount of real property tax that had been included in the 2021-22 budget while also giving owners some relief and moving the city closer to the significantly lower property tax rates in neighboring Henrico and Chesterfield counties. Print Back to top.

Car Tax Credit -PPTR. Average Property Tax Rate in New Richmond. With our resource you will learn useful information about New Richmond property taxes and get a better understanding of what to consider when you have to pay.

The real estate tax rate is 120 per 100 of the properties assessed value. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp. Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph.

Ultimate New Richmond Real Property Tax Guide for 2021. Residential Property Tax Rate for Richmond Hill from 2018 to 2021. Real estate taxes are due on January 14th and June 14th each year.

Based on latest. Richmond City has one of the highest median property taxes in the United States and is. Tax Rate 2062 - 100 assessment.

FY 2021 Rhode Island Tax Rates by Class of Property Tax Roll Year 2020. Yearly median tax in Richmond City. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead.

2 1000 of assmt value between 3M to 4M 0002 Tier 2. Over 4M 4 1000 of assessment value over 4M 0004 City of Richmond 2021 TAX RATES New Additional School Tax for Qualifying Residential Properties. Estate tax is the result of multiplying the FMV of the property times the real estate tax rate established by Richmond City Council.

Learn all about Richmond real estate tax. That the Annual Prope1ty Tax Rates 2021 Bylaw No. For all who owned property on January 1 even if the property has been sold a tax bill will still be sent.

The rates will be adjusted for 163 cents on each 100 of personal property and 134 cents on each 100 worth of real. Residential Property Tax Rate for Richmond from 2018 to 2021. What is considered real property.

For more information call 706-821-2391. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Between 3M to 4M.

Whether you are already a resident or just considering moving to Richmond to live or invest in real estate estimate local property tax rates and learn how real estate tax works. If Richmond property tax rates are too costly for you and. April 7 2021 File.

View more information about payment responsibility. RICHMOND 2 6 2038 2038 2038 2264 SCITUATE 6 1827 2267 3892 3020. Payments cannot be taken at the tax commissioners tag offices.

Parks Trails. Annual Property Tax Rates 2021 Bylaw No. 105 of home value.

Property Taxes Due 2021 property tax bills were due as of November 15 2021. Recreation Sport. West Warwick - Real Property taxed at four different rates.

2021 Richmond Millage Rates. Vehicle License Tax Vehicles. Year Municipal Rate Educational Rate Final Tax Rate.

To view previous years Millage Rates for the City of Richmond please click here. Vehicle License Tax Motorcycles. Real Property residential and commercial and Personal Property.

2022 Tax Rates. The total taxable value of Richmond real estate rose 73 percent in new tax assessment notices mailed to city property owners this week the biggest year-over-year increase in a decade. What is the real estate tax rate for 2021.

Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February 28th. Property value 100000 Property Value 100 1000 1000 x 120 tax rate 1200 real estate tax Can I appeal my real estate assessment. 10249 be introduced and given first second and third readings.

Year Municipal Rate Educational Rate Final Tax Rate. Tax Sales Property Auction.

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Toronto Property Taxes Explained Canadian Real Estate Wealth

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

About Your Tax Bill City Of Richmond Hill

Using His Luxury Horse Farm To Dodge Property Taxes Glenn Youngkin Is Sounding More And More Like His Idol Donald Trump Every Day Blue Virginia

City Of Richmond Adopts 2022 Budget And Tax Rate

Tax Bill Information Macomb Mi

Virginia Property Tax Calculator Smartasset

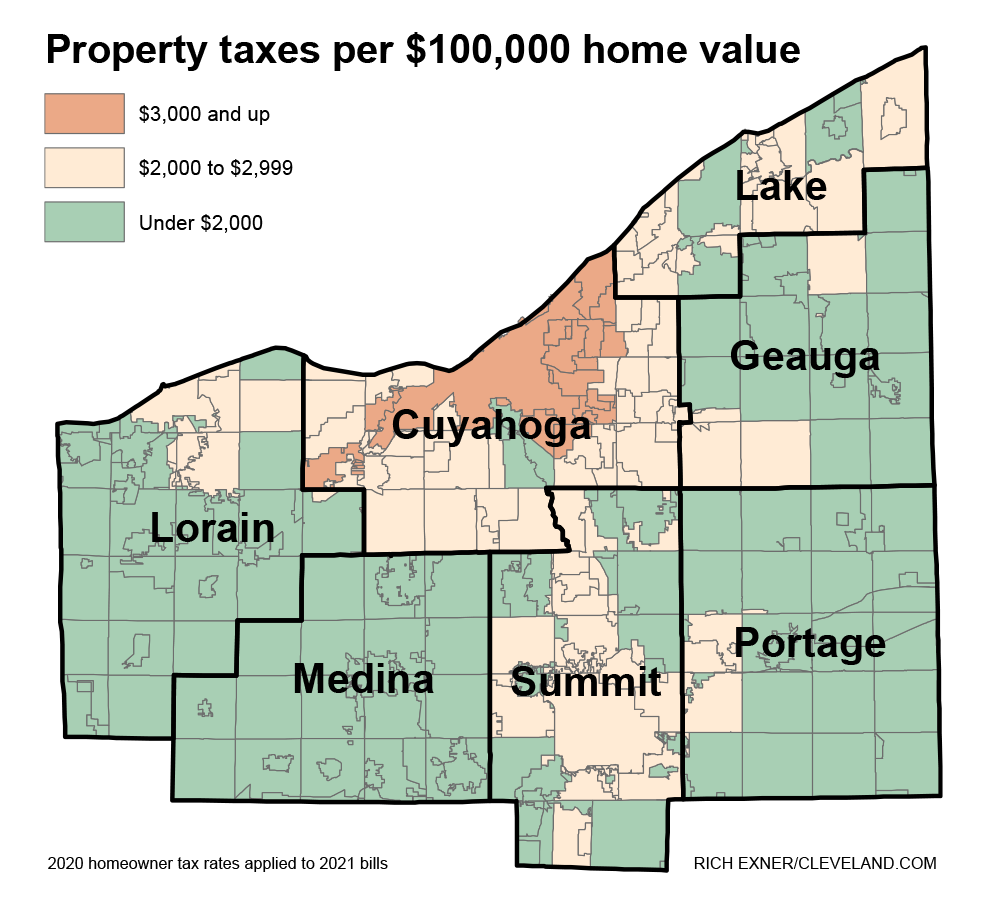

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Vermont Property Tax Rates Nancy Jenkins Real Estate

Lower Mainland 2022 Property Assessments In The Mail

Richmond Ky Taxes Incentives Richmond Industrial Development Corporation

Toronto Property Taxes Explained Canadian Real Estate Wealth

Ontario Property Tax Rates Lowest And Highest Cities

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Soaring Home Values Mean Higher Property Taxes