stock option tax calculator ireland

Stock options There are a number of issues with the current taxation of stock options. Your payroll taxes on gains from.

Annual Income Tax Calculator 2022 Salary Calculator

Example of Reduced Capital Gains Tax on Shares in Ireland.

. Cost of Shares10000 shares 1 10000. Open an Account Now. When you exercise a qualifying share option under the KEEP programme any gain will not be subject to income tax PRSI or USC.

Ad Trade with the Options Platform Awarded for 7 Consecutive Years. On the date of exercise the fair market value of the stock was 25 per share which is. Taxes for Non-Qualified Stock Options.

How to calculate and pay Relevant Tax on Share Options Rate of tax. EToro income will also be subject to Universal Social Charge USC. Companies Irish branches and agencies granting options including an Irish employer where the options are granted by a non resident parent company must complete.

The wage base is 142800 in 2021 and 147000 in 2022. Website Explorers Socials etc. 4 HI hospital insurance or Medicare is 145 on all earned income.

Enter the amount of your new grant - whether an offer grant or an annual refresh. The gain will be subject to Capital Gains Tax when you. However when you exercise a non-statutory stock option NSO youre liable for ordinary income tax on the difference between the price you paid for the stock and the current.

You paid 10 per share the exercise price which is reported in box 3 of Form 3921. Open an Account Now. Estimate how much your RSU value will.

Hi everyone Im interested in starting to trade US stock options contracts. Ireland Stock Options Tax forex trading for beginners training forex basics investopedia belajar forex live trading. Income Tax rates are currently 20 and 40.

Ad Trade with the Options Platform Awarded for 7 Consecutive Years. Exercising your non-qualified stock options triggers a tax. These shares are a benefit in kind BIK.

USC is tax payable on an individuals total income. In October 2022 they are worth 800 each. The first 1270 of gains made by any individual in a tax year are exempt from Capital Gains Tax and so the.

Stock options restricted stock restricted stock units performance shares stock appreciation rights and. This is calculated as follows. Enter the number of shares purchased.

If you sold all 500 shares then your total gain would be 2500. Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422 b. To use the RSU projection calculator walk through the following steps.

Value of Shares10000 shares 3 30000. A share option is the right to buy a certain number of shares at a fixed price sometime in the future within a company. This places Ireland on the 8th place in the International Labour.

Marginal tax rates currently up to 52 apply on the exercise of share options. Lets say you got a grant price of 20 per share but when you exercise your. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 1600 EUR per month.

You purchase 10 Irish shares in January 2022 at a cost of 500 each. Assuming the 40 tax rate applies the tax on. This paper profit is immediately liable for income tax and must be paid over to the Revenue within 30 days of exercising the option.

The Stock Calculator is very simple to use. The Income Tax IT and Universal Social Charge USC due on the exercise of a share option is known as. The problem is that there is literally no information in the Internet about how this activity would be taxed in.

Enter the purchase price per share the selling price per share. An ESPP or Employee Stock Purchase Plan is an employer perk that allows employees to purchase a companys stock at a discount. The Global Tax Guide explains the taxation of equity awards in 43 countries.

Just follow the 5 easy steps below. Using the ESPP Tax and Return Calculator.

How Bonuses Are Taxed Calculator The Turbotax Blog

Income Tax It Returns Rules What Is Income Tax For Fy 2019 20

Bitcoin Tax Calculator Calculate Your Tax On Bitcoin

Debt Arrangement Scheme Uk Www Debtarrangeme Debt Arrangement Scheme Scotland Mortgage Repayment Calcula Mortgage Repayment Calculator Debt Problem Repayment

What Is The Formula To Calculate Income Tax

Income Tax All You Need To Know About Your Income Tax Return

How To Calculate Capital Gains Short Long Term Fy 2021 22

How Is Yield Farming Taxed Koinly

.png)

Fifo Lifo And Hifo What S The Best Method For Crypto Cryptotrader Tax

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

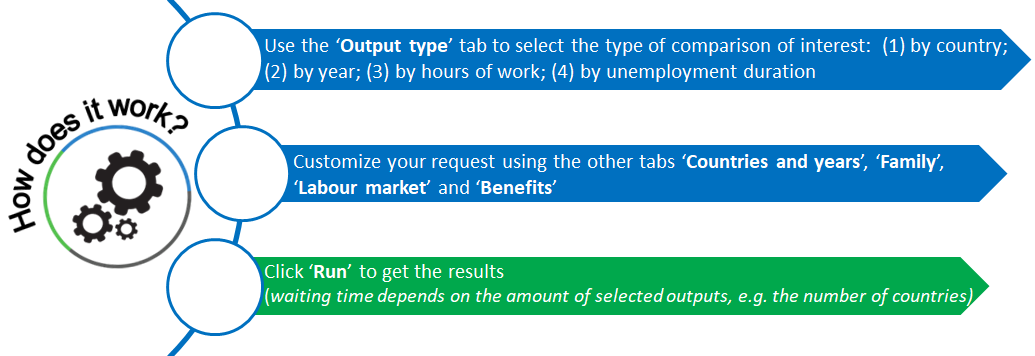

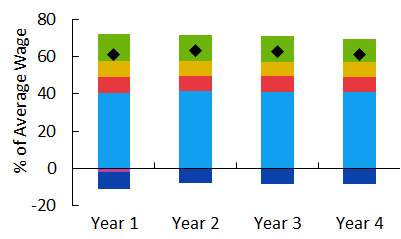

Tax Benefit Web Calculator Oecd

Bitcoin Tax Calculator Calculate Your Tax On Bitcoin

How To Calculate Taxable Income H R Block

Is Life Insurance Taxable Forbes Advisor

Tax Benefit Web Calculator Oecd

I Am Relocating To Ireland And Have A Salary Of 43 200 Euros What Will Be My Disposable Income After Taxes Quora

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International